Performance/Indicator Highlights

(Unit: Millions of yen)

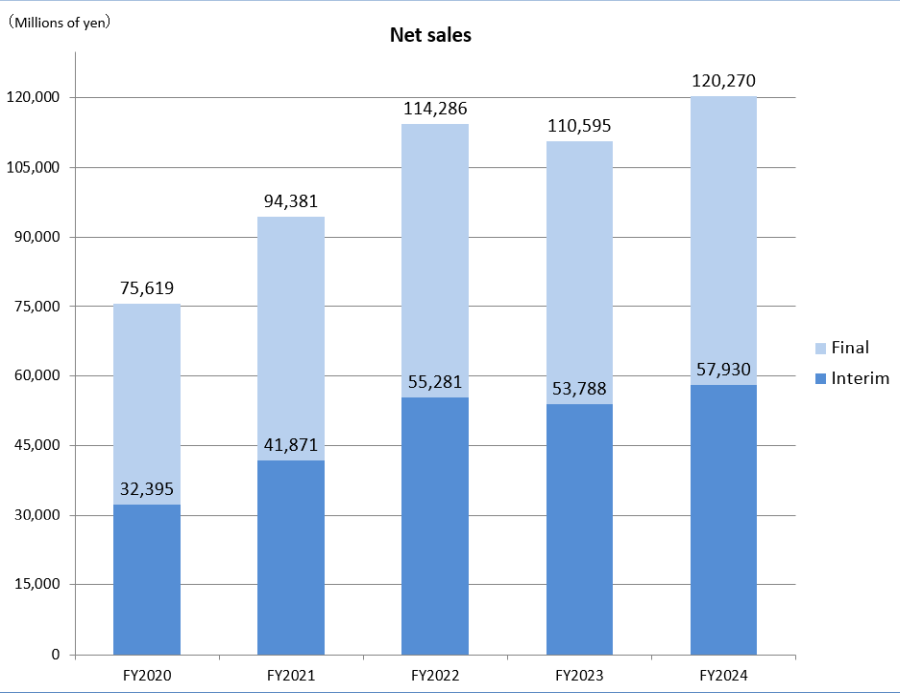

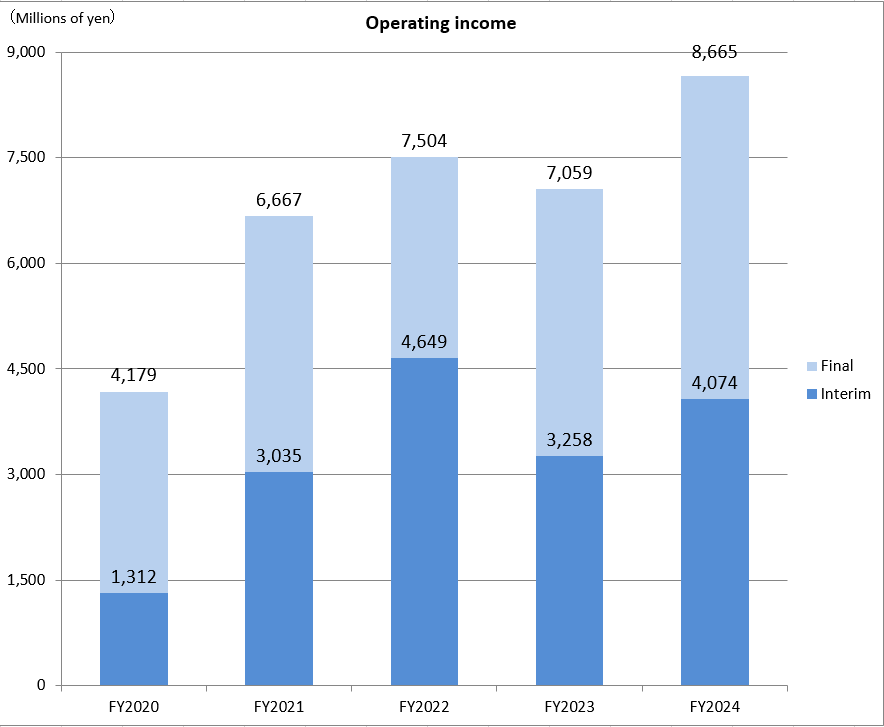

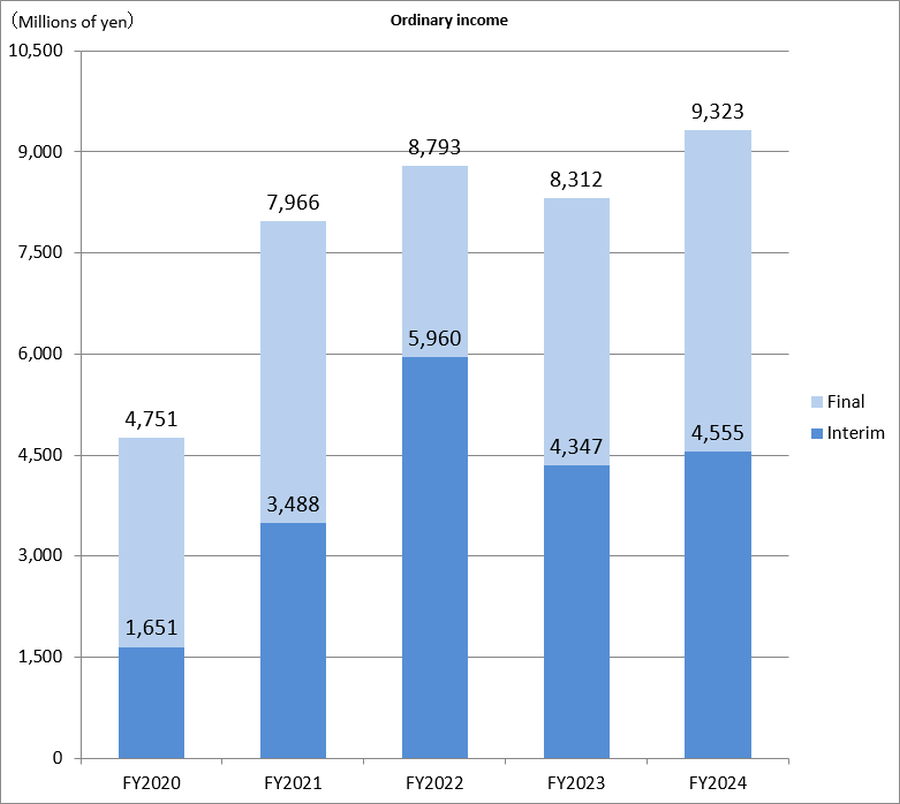

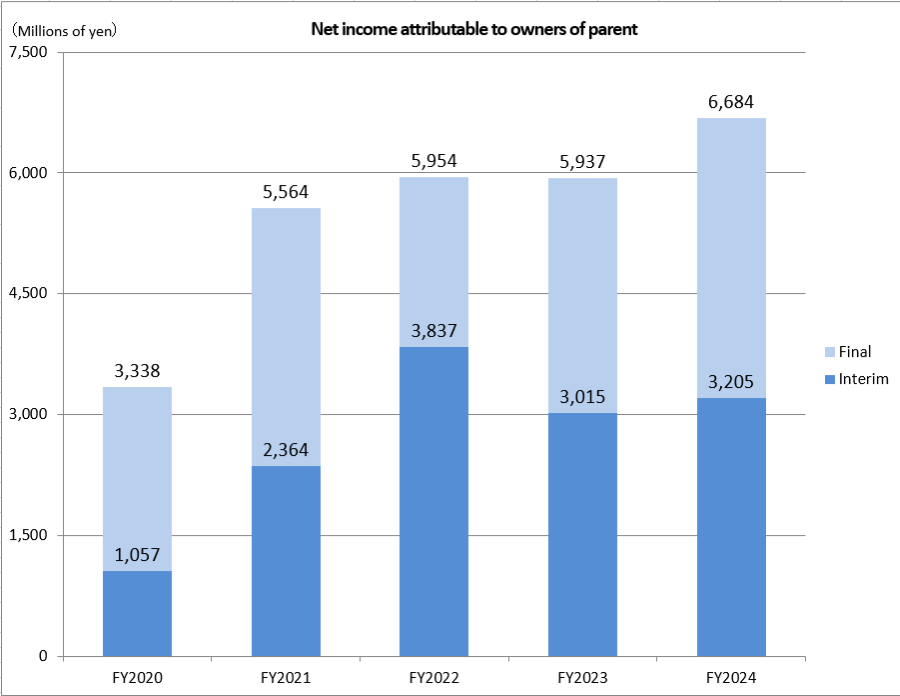

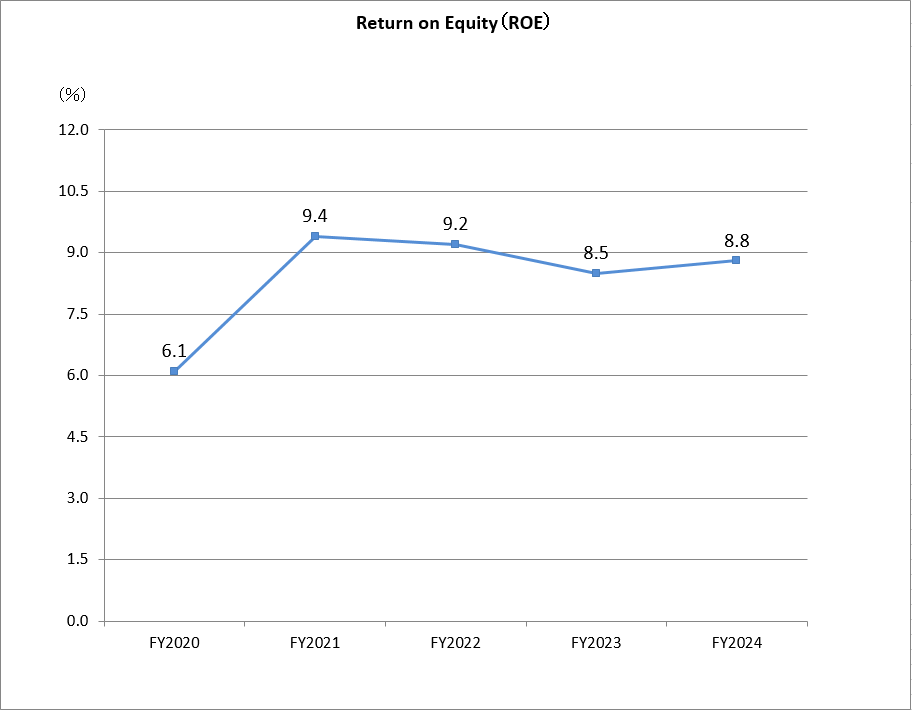

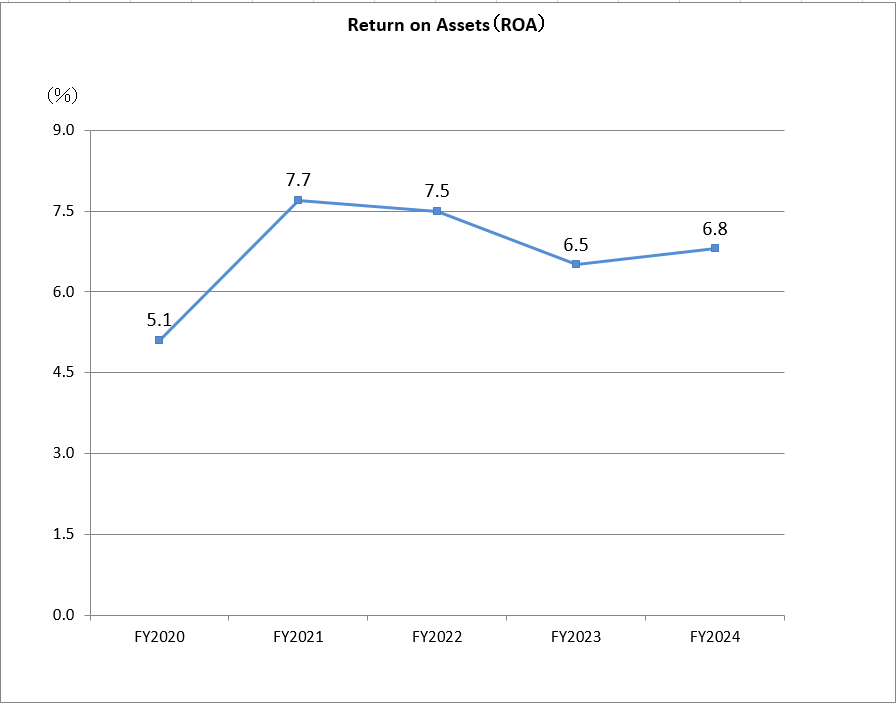

| (Consolidated) | FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | FY2025 (forecast) |

|---|---|---|---|---|---|---|

| Net sales | 75,619 | 94,381 | 114,286 | 110,595 | 120,270 | 128,000 |

| Operating Income | 4,179 | 6,667 | 7,504 | 7,059 | 8,665 | 7,700 |

| Ordinary Income | 4,751 | 7,966 | 8,793 | 8,312 | 9,323 | 7,600 |

| Net income attributable to owners of parent | 3,338 | 5,564 | 5,954 | 5,937 | 6,684 | 5,300 |

| ROE | 6.1 | 9.4 | 9.2 | 8.5 | 8.8 | ― |

| ROA | 5.1 | 7.7 | 7.5 | 6.5 | 6.8 | ― |

- Return on Equity (ROE) = Net income attributable to owners of parent / Shareholder's equity×100

- Return on Assets (ROA) = Ordinary income / Assets×100

Dividends

Policy

In 2028 medium-term management plan(FY2024-FY2028),our basic policy is to distribute profits in line with performance while maintaining stable dividends,aiming for a consolidated payout ratio of 30% or more.